Refinancing a Mortgage in the USA: When Does It Make Sense?

Calculate Your Mortgage Now

Get instant estimates for your monthly payments

Introduction

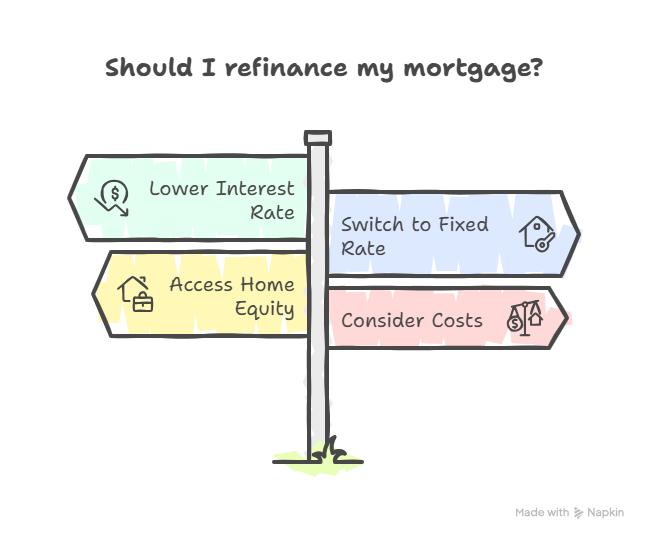

Refinancing your mortgage can feel like pressing the reset button on your home loan. For homeowners in the USA, refinancing offers a chance to lower interest rates, reduce monthly payments, or tap into home equity. But refinancing isn’t always the right choice. It comes with costs, timing considerations, and financial risks.

So, how do you know when refinancing your mortgage actually makes sense? In this blog, we’ll explore the reasons to refinance, the costs involved, and how to calculate whether it’s truly worth it.

What Is Mortgage Refinancing?

Mortgage refinancing means replacing your current home loan with a new one, usually with better terms. The new loan pays off your old mortgage, and you begin making payments under the new agreement.

Refinancing can help you:

- Lower your interest rate

- Shorten or extend your loan term

- Switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage

- Access your home’s equity through a cash-out refinance

When Does Refinancing Make Sense?

1. When Interest Rates Drop Significantly

If mortgage rates fall, refinancing can save you thousands of dollars over the life of your loan. A common rule of thumb: if you can lower your rate by 0.5% to 1%, it may be worth considering.

Example: On a $300,000 loan, lowering your rate from 6.5% to 5.5% could save you over $180 per month. Use our mortgage calculator

to see your potential savings.

2. When You Want to Lower Monthly Payments

If your budget feels tight, refinancing to a longer-term loan (e.g., from 15 years to 30 years) can reduce your monthly payments. However, you may end up paying more interest in the long run.

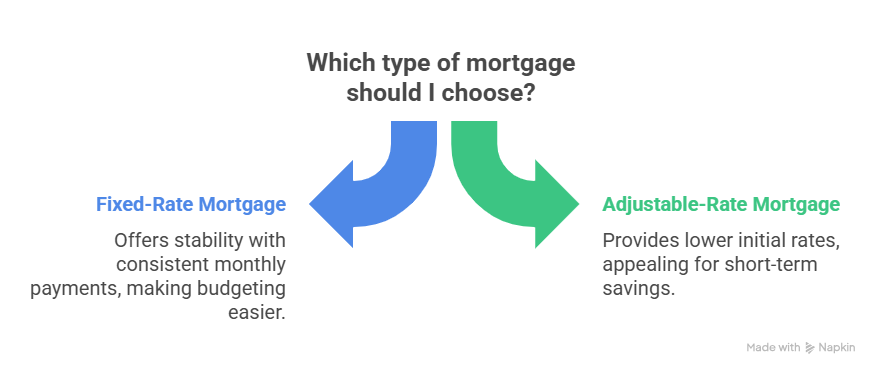

3. When Switching Loan Types Benefits You

- ARM to Fixed-Rate: If you have an adjustable-rate mortgage and worry about rising interest rates, refinancing into a fixed-rate loan locks in predictable monthly payments.

- Fixed to ARM: In some cases, switching from a fixed to an ARM can reduce initial payments if you plan to sell your home within a few years.

4. When You Want to Build Equity Faster

Refinancing from a 30-year to a 15-year mortgage means higher monthly payments, but you’ll pay off your home faster and save big on interest. This works well if your income has increased and you can afford larger payments.

5. When You Need Cash for Big Expenses

A cash-out refinance lets you borrow against your home equity. Homeowners often use this option to pay for:

- Home improvements

- College tuition

- Debt consolidation

However, this can be risky because you’re increasing your loan balance.

When Refinancing Might Not Make Sense

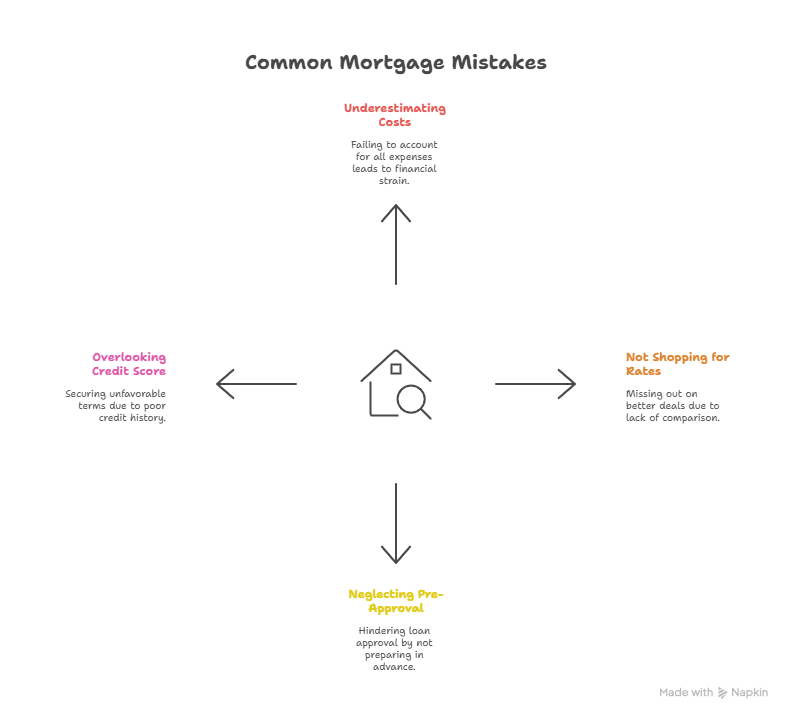

- High Closing Costs: Refinancing isn’t free. Expect to pay 2%–5% of your loan amount in closing costs. If you’re only saving $100 a month, it may take years to break even.

- Short-Term Plans: If you plan to sell your home soon, refinancing may not be worth the upfront costs.

- Poor Credit Score: If your credit has worsened since you got your original mortgage, you may not qualify for a better deal.

How to Calculate If Refinancing Is Worth It

- Check Your Break-Even Point

- This is how long it will take for your savings to cover your refinancing costs.

Example:

- Closing costs: $6,000

- Monthly savings: $200

- Break-even point = $6,000 ÷ $200 = 30 months (2.5 years)

If you plan to stay in your home longer than 2.5 years, refinancing could make sense.

- Use a Mortgage Calculator

- Our mortgage calculator

- helps you compare your current loan with refinancing options so you can see potential monthly and lifetime savings.

Pros and Cons of Refinancing

Pros:

- Lower interest rates

- Reduce monthly payments

- Pay off mortgage faster

- Access home equity

Cons:

- High closing costs

- Longer repayment period (if you extend loan term)

- Risk of losing equity

- Possible prepayment penalties on your current loan

Expert Tips for Refinancing in the USA

- Shop Around for Rates

- Don’t accept the first offer. Compare lenders to find the best deal.

- Improve Your Credit Score First

- A higher score can get you lower interest rates.

- Negotiate Closing Costs

- Some fees can be reduced or waived if you ask.

- Watch Market Trends

- If rates are falling, it may be wise to wait a little. If rates are rising, locking in now might be smarter.

Conclusion

Refinancing a mortgage in the USA can be a powerful financial move—but only when done at the right time. Whether you’re aiming to lower your payments, secure a better rate, or access cash from your equity, you need to weigh the benefits against the costs.

The key is to calculate carefully, plan ahead, and shop around for the best deal. Use the USA Mortgage Tools calculator

to explore different refinancing scenarios before making your decision.

Ready to Calculate Your Mortgage?

Use our free mortgage calculator to estimate your monthly payments and see what you can afford.

Calculate Now